Introduction

Data evaluating the costs associated with developing novel therapeutics within the pharmaceutical industry can be used to identify trends over time and can inform more accurate budgeting for future research projects. However, the cost to develop a drug therapeutic is difficult to accurately evaluate, resulting in varying estimates ranging from hundreds of millions to billions of US dollars between studies. The high cost of drug development is not purely because of clinical trial expenses. Drug discovery, pre-clinical trials, and commercialisation also need to be factored into estimates of drug development costs.

There are limitations in trying to accurately assess these costs. The sheer number of factors that affect estimated and real costs means that studies often take a more specific approach. For example, costs will differ between large multinational companies with multiple candidates in their pipeline and start-ups/SMEs developing their first pharmaceutical. Due to the amount and quality of available data, many studies work mostly with data from larger multinational pharmaceutical companies with multiple molecules in the pipeline. When taken out of context, the “$2.6 billion USD cost for getting a single drug to market” can seem daunting for SMEs. It is very important to clarify what scale these cost estimates represent, but cost data from large pharma companies are still relevant for SMEs as they can used to infer costs for different scales of therapeutic development.

This mini-report includes what drives clinical trial costs, methods to reduce these costs, and then explores what can be learned from varying cost estimates.

What drives clinical trial costs?

There is an ongoing effort to streamline the clinical trial process to be more cost and time efficient. Several studies report on cost drivers of clinical trials, which should be considered when designing and budgeting a trial. Some of these drivers are described below:

Study size

Trial costs rise exponentially with an increasing study size, which some studies have found to be the single largest driver in trial costs1,2,3. There are several reasons for varying sample sizes between trials. For example, study size increases with trial phase progression as phases require different study sizes based on the number of patients needed to establish the safety and/or effectiveness of a treatment. Failure to recruit sufficient patients can result in trial delays which also increases costs4.

Trial site visits

A large study size is also correlated with a larger overall number of patient visits during a trial, which is associated with a significant increase in total trial costs2,3. Trial clinic visits are necessary for patient screening, treatment and treatment assessment but include significant costs for staff, site hosting, equipment, treatment, and in some cases reimbursement for patient travel costs. The number of trial site visits per patient varies between trials where more visits may indicate longer and/or more intense treatment sessions. One estimate for the number of trial visits per person was a median of 11 in a phase III trial, with $2 million added to estimated trial costs for every +1 to the median2.

Number & location of clinical trial sites

A higher number of clinical trial study sites has been associated with significant increase in total trial cost3. This is a result of increased site costs, as well as associated staffing and equipment costs. These will vary with the size of each site, where larger trials with more patients often use more sites or larger sites.

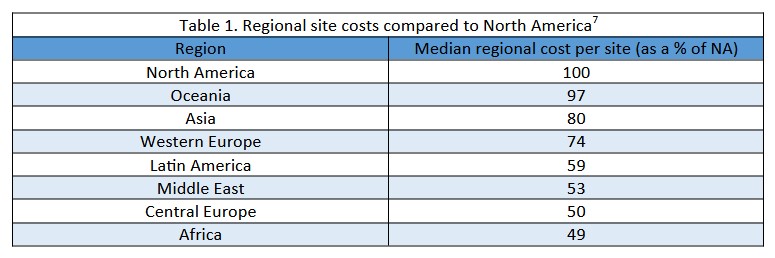

Due to the lower cost and shorter timelines of overseas clinical research5,6, there has been a shift to the globalisation of trials, with only 43% of study sites in US FDA-approved pivotal trials being in North America7. In fact, 71% of these trials had sites in lower cost regions where median regional costs were 49%-97% of site costs in North America. Most patients in these trials were either in North America (39.7%), Western Europe (21%), or Central Europe (20.4%).

However, trials can face increased difficulties in managing and coordinating multiple sites across different regions, with concerns of adherence to the ethical and scientific regulations of the trial centre’s region5,6. Some studies have reported that multiregional trials are associated with a significant increase in total trial costs, especially those with sites in emerging markets3. It is unclear if this reported increase is a result of lower site efficiency, multiregional management costs, or outsourcing being more common among larger trials.

Clinical Trial duration

Longer trial duration has been associated with a significant increase in total trial costs3,4, where many studies have estimated the clinical period between 6-8 years8,9,10,11,12,13. Longer trials are sometimes necessary, such as in evaluating the safety and efficacy of long-term drug use in the management of chronic and degenerative disease. Otherwise, delays to starting up a trial contribute to longer trials, where delays can consume budget and diminish the relevance of research4. Such delays may occur as a result of site complications or poor patient accrual.

Another aspect to consider is that the longer it takes to get a therapeutic to market (as impacted by longer trials), the longer the wait is before a return of investment is seen by both the research organisation and investors. The period from development to on-market, often referred to as cycle time, can drive costs per therapeutic as interest based on the industry’s cost of capital can be applied to investments.

Therapeutic area under investigation

The cost to develop a therapeutic is also dependent on the therapeutic area, where some areas such as oncology and cardiovascular treatments are more cost intensive compared with others1,2,5,6,12,14. This is in part due to variation in treatment intensity, from low intensity treatments such as skin creams to high intensity treatments such as multiple infusions of high-cost anti-cancer drugs2. An estimate for the highest mean cost for pivotal trials per therapeutic area was $157.2M in cardiovascular trials compared to $45.4M in oncology, and a lowest of $20.8M in endocrine, metabolic, and respiratory disease trials1. This was compared to an overall median of $19M. Clinical

trial costs per therapeutic area also varied by clinical trial phase. For example, trials in pain and anaesthesia have been found to have the lowest average cost of a phase I study while having the highest average cost of a phase III study6.

It is important to note that some therapeutic areas will have far lower per patient costs when compared to others and are not always indicative of total trial costs. For example, infectious disease trials generally have larger sample sizes which will lead to relatively low per patient costs, whereas trials for rare disease treatment are often limited to smaller sample sizes with relatively high per patient costs. Despite this, trials for rare disease are estimated to have significantly lower drug to market costs.

Drug type being evaluated

As mentioned in the therapeutic areas section above, treatments may vary in intensity from skin creams to multiple rounds of treatment with several anti-cancer drugs. This can drive total trial costs due to additional manufacturing and the need for specially trained staff to administer treatments.

In the case of vaccine development, phase III/pivotal trials for vaccine efficacy can be very difficult to run unless there are ongoing epidemics for the targeted infectious disease. Therefore, some cost estimates of vaccine development include from the pre-clinical stages to the end of phase IIa, with the average cost for one approved vaccine estimated at $319-469 million USD in 201815.

Study design & trial control type used

Phase III trial costs vary based on the type of control group used in the trial1. Uncontrolled trials were the least expensive with an estimated mean of $13.5 million per trial. Placebo controlled trials had an estimated mean of $28.8 million, and trials with active drug comparators had an estimated mean cost of $48.9 million. This dramatic increase in costs is in part due to manufacturing and staffing to administer a placebo or active drug. In addition, drug-controlled trials require more patients compared to placebo-controlled, which also requires more patients than uncontrolled trials2.

Reducing therapeutic development costs

Development costs can be reduced through several approaches. Many articles recommend improvements to operational efficiency and accrual, as well as deploying standardised trial management metrics4. This could include streamlining trial administration, hiring experienced trial staff, and ensuring ample patient recruitment to reduce delays in starting and carrying out a study.

Another way to reduce development costs can take place in the thorough planning of clinical trial design by a biostatistician, whether in-house or external. Statistics consulting throughout a trial can help to determine suitable early stopping conditions and the most appropriate sample size. Sample size calculation is particularly important as underestimation undermines experimental results, whereas overestimation leads to unnecessary costs. Statisticians can also be useful during the pre-clinical stage to audit R&D data to select the best available candidates, ensure accurate R&D data analysis, and avoid pursuing unsuccessful compounds.

Other ways to reduce development costs include the use of personalised medicine, clinical trial digitisation, and the integration of AI. Clinical trial digitisation would lead to the streamlining of clinical trial administration and would also allow for the integration of artificial intelligence into clinical trials. There have been many promising applications for AI in clinical trials, including the use of electronic health records to enhance the enrolment and monitoring of patients, and the potential use of AI in trial diagnostics. More information about this topic can be found in our blog “Emerging use-cases for AI in clinical trials”.

For more information on the methodology by which pharmaceutical development and clinical trials costs are estimated and what data has been used please see the article: https://anatomisebiostats.com/biostatistics-blog/estimating-the-costs-associated-with-novel-pharmaceutical-development-methods-and-limitations/

Cost breakdown in more detail: How is a clinical trial budget spent?

Clinical trial costs can be broken down and divided into several categories, such as staff and non-staff costs. In a sample of phase III studies, personnel costs were found to be the single largest component of trial costs, consisting of 37% of the total, whereas outsourcing costs made up 22%, grants and contracting costs at 21%, and other expenses at 21%3.

From a CRO’s perspective, there are many factors that are considered in the cost of a pivotal trial quotation, including regulatory affairs, site costs, management costs, the cost of statistics and medical writing, and pass-through costs27. Another analysis of clinical trial cost factors determined clinical procedure costs made up 15-22% of the total budget, with administrative staff costs at 11-29%, site monitoring costs at 9-14%, site retention costs at 9-16%, and central laboratory costs at 4-12%5,6. In a study of multinational trials, 66% of total estimated trial costs were spent on regional tasks, of which 53.3% was used in trial sites and the remainder on other management7.

Therapeutic areas and shifting trends

Therapeutic area had previously been mentioned as a cost driver of trials due to differences in sample sizes and/or treatment intensity. It is however worth mentioning that, in 2013, the largest number of US industry-sponsored clinical trials were in oncology (2,560/6,199 active clinical trials with 215,176/1,148,340 patients enrolled)4,14. More recently, there has been a shift to infectious disease trials, in part due to the needed COVID-19 trials9.

Clinical trial phases

Due to the expanding sample size as a trial progresses, average costs per phase increase from phase I through III. Median costs per phase were estimated in 2016 at $3.4 million for phase I, $8.6 million for phase II, and $21.4 million for phase III3. Estimations of costs per patient were similarly most expensive in phase III at $42,000, followed by phase II at $40,000 and phase I at $38,50014. The combination of an increasing sample size and increasing per patient costs per phase leads to the drastic increase in phase costs with trial progression.

In addition, studies may have multiple phase III trials, meaning the median estimated cost of phase III trials per approved drug is higher than per trial costs ($48 million and $19 million respectively)2. Multiple phase III trials can be used to better support marketing approval or can be used for therapeutics which seek approval for combination/adjuvant therapy.

There are fewer cost data analyses available on phase 0 and phase IV on clinical trials. Others report that average Phase IV costs are equivalent to Phase III but much more variable5,6.

Orphan drugs

Drugs developed for the treatment of rare diseases are often referred to as orphan drugs. Orphan drugs have been estimated to have lower clinical costs per approved drug, where capitalised costs per non-orphan and orphan drugs were $412 million and $291 million respectively17. This is in part due to the limit to sample size imposed upon orphan drug trials by the rarity of the target disease and the higher success rate for each compound. However, orphan drug trials are often longer when compared to non-orphan drug trials, with an average study duration of 1417 days and 774 days respectively.

NMEs

New molecular entities (NMEs) are drugs which do not contain any previously approved active molecules. Both clinical and total costs of NMEs are estimated to be higher when compared to next in class drugs13,17. NMEs are thought to be more expensive to develop due to the increased amount of pre-clinical research to determine the activity of a new molecule and the increased intensity of clinical research to prove safety/efficacy and reach approval.

Conclusion & take-aways

There is no one answer to the cost of drug or device development, as it varies considerably by several cost drivers including study size, therapeutic area, and trial duration. Estimates of total drug development costs per approved new compound have ranged from $754 million12 to $2.6 billion10 USD over the past 10 years. These estimates do not only differ based on the data used, but also due to methodological differences between studies. The limited availability of comprehensive cost data for approved drugs also means that many studies rely on limited data sets and must make assumptions to arrive at a reasonable estimate.

There are still multiple practical ways that can be used to reduce study costs, including expert trial design planning by statisticians, implementation of biomarker-guided trials to reduce the risk of failure, AI integration and digitisation of trials, improving operational efficiency, improving accrual, and introducing standardised trial management metrics.

References

Moore T, Zhang H, Anderson G, Alexander G. Estimated Costs of Pivotal Trials for Novel Therapeutic Agents Approved by the US Food and Drug Administration, 2015-2016. JAMA Internal Medicine. 2018;178(11):1451-1457.

.1 Moore T, Zhang H, Anderson G, Alexander G. Estimated Costs of Pivotal Trials for Novel Therapeutic Agents Approved by the US Food and Drug Administration, 2015-2016. JAMA Internal Medicine. 2018;178(11):1451-1457.

2. Moore T, Heyward J, Anderson G, Alexander G. Variation in the estimated costs of pivotal clinical benefit trials supporting the US approval of new therapeutic agents, 2015–2017: a cross-sectional study. BMJ Open. 2020;10(6):e038863.

3. Martin L, Hutchens M, Hawkins C, Radnov A. How much do clinical trials cost?. Nature Reviews Drug Discovery. 2017;16(6):381-382.

4. Bentley C, Cressman S, van der Hoek K, Arts K, Dancey J, Peacock S. Conducting clinical trials—costs, impacts, and the value of clinical trials networks: A scoping review. Clinical Trials. 2019;16(2):183-193.

5. Sertkaya A, Birkenbach A, Berlind A, Eyraud J. Examination of Clinical Trial Costs and Barriers for Drug Development [Internet]. ASPE; 2014. Available from: https://aspe.hhs.gov/reports/examination-clinical-trial-costs-barriers-drug-development-0

6. Sertkaya A, Wong H, Jessup A, Beleche T. Key cost drivers of pharmaceutical clinical trials in the United States. Clinical Trials. 2016;13(2):117-126.

7. Qiao Y, Alexander G, Moore T. Globalization of clinical trials: Variation in estimated regional costs of pivotal trials, 2015–2016. Clinical Trials. 2019;16(3):329-333.

8. Monitor Deloitte. Early Value Assessment: Optimising the upside value potential of your asset [Internet]. Deloitte; 2020 p. 1-14. Available from: https://www2.deloitte.com/content/dam/Deloitte/be/Documents/life-sciences-health-care/Deloitte%20Belgium_Early%20Value%20Assessment.pdf

9. May E, Taylor K, Cruz M, Shah S, Miranda W. Nurturing growth: Measuring the return from pharmaceutical innovation 2021 [Internet]. Deloitte; 2022 p. 1-28. Available from: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/life-sciences-health-care/Measuring-the-return-of-pharmaceutical-innovation-2021-Deloitte.pdf

10. DiMasi J, Grabowski H, Hansen R. Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics. 2016;47:20-33.

11. Farid S, Baron M, Stamatis C, Nie W, Coffman J. Benchmarking biopharmaceutical process development and manufacturing cost contributions to R&D. mAbs. 2020;12(1):e1754999.

12. Wouters O, McKee M, Luyten J. Estimated Research and Development Investment Needed to Bring a New Medicine to Market, 2009-2018. JAMA. 2020;323(9):844-853.

13. Prasad V, Mailankody S. Research and Development Spending to Bring a Single Cancer Drug to Market and Revenues After Approval. JAMA Internal Medicine. 2017;177(11):1569-1575.

14. Battelle Technology Partnership Practice. Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies [Internet]. Pharmaceutical Research and Manufacturers of America; 2015. Available from: http://phrma-docs.phrma.org/sites/default/files/pdf/biopharmaceutical-industry-sponsored-clinical-trials-impact-on-state-economies.pdf

15. Gouglas D, Thanh Le T, Henderson K, Kaloudis A, Danielsen T, Hammersland N et al. Estimating the cost of vaccine development against epidemic infectious diseases: a cost minimisation study. The Lancet Global Health. 2018;6(12):e1386-e1396.

16. Hind D, Reeves B, Bathers S, Bray C, Corkhill A, Hayward C et al. Comparative costs and activity from a sample of UK clinical trials units. Trials. 2017;18(1).

17.Jayasundara K, Hollis A, Krahn M, Mamdani M, Hoch J, Grootendorst P. Estimating the clinical cost of drug development for orphan versus non-orphan drugs. Orphanet Journal of Rare Diseases. 2019;14(1).

19. Speich B, von Niederhäusern B, Schur N, Hemkens L, Fürst T, Bhatnagar N et al. Systematic review on costs and resource use of randomized clinical trials shows a lack of transparent and comprehensive data. Journal of Clinical Epidemiology. 2018;96:1-11.

20. Light D, Warburton R. Demythologizing the high costs of pharmaceutical research. BioSocieties. 2011;6(1):34-50.

21. Adams C, Brantner V. Estimating The Cost Of New Drug Development: Is It Really $802 Million?. Health Affairs. 2006;25(2):420-428.

22. Thomas D, Chancellor D, Micklus A, LaFever S, Hay M, Chaudhuri S et al. Clinical Development Success Rates and Contributing Factors 2011–2020 [Internet]. BIO|QLS Advisors|Informa UK; 2021. Available from: https://pharmaintelligence.informa.com/~/media/informa-shop-window/pharma/2021/files/reports/2021-clinical-development-success-rates-2011-2020-v17.pdf

23. Wong C, Siah K, Lo A. Estimation of clinical trial success rates and related parameters. Biostatistics. 2019;20(2):273-286.

24. Chit A, Chit A, Papadimitropoulos M, Krahn M, Parker J, Grootendorst P. The Opportunity Cost of Capital: Development of New Pharmaceuticals. INQUIRY: The Journal of Health Care Organization, Provision, and Financing. 2015;52:1-5.

25. Harrington, S.E. Cost of Capital for Pharmaceutical, Biotechnology, and Medical Device Firms. In Danzon, P.M. & Nicholson, S. (Eds.), The Oxford Handbook of the Economics of the Biopharmaceutical Industry, (pp. 75-99). New York: Oxford University Press. 2012.

26. Zhuang J, Liang Z, Lin T, De Guzman F. Theory and Practice in the Choice of Social Discount Rate for Cost-Benefit Analysis: A Survey [Internet]. Manila, Philippines: Asian Development Bank; 2007. Available from: https://www.adb.org/sites/default/files/publication/28360/wp094.pdf

27. Rennane S, Baker L, Mulcahy A. Estimating the Cost of Industry Investment in Drug Research and Development: A Review of Methods and Results. INQUIRY: The Journal of Health Care Organization, Provision, and Financing. 2021;58:1-11.

28. Ledesma P. How Much Does a Clinical Trial Cost? [Internet]. Sofpromed. 2020 [cited 26 June 2022]. Available from: https://www.sofpromed.com/how-much-does-a-clinical-trial-cost